Business Insurance in and around Cincinnati

One of the top small business insurance companies in Cincinnati, and beyond.

No funny business here

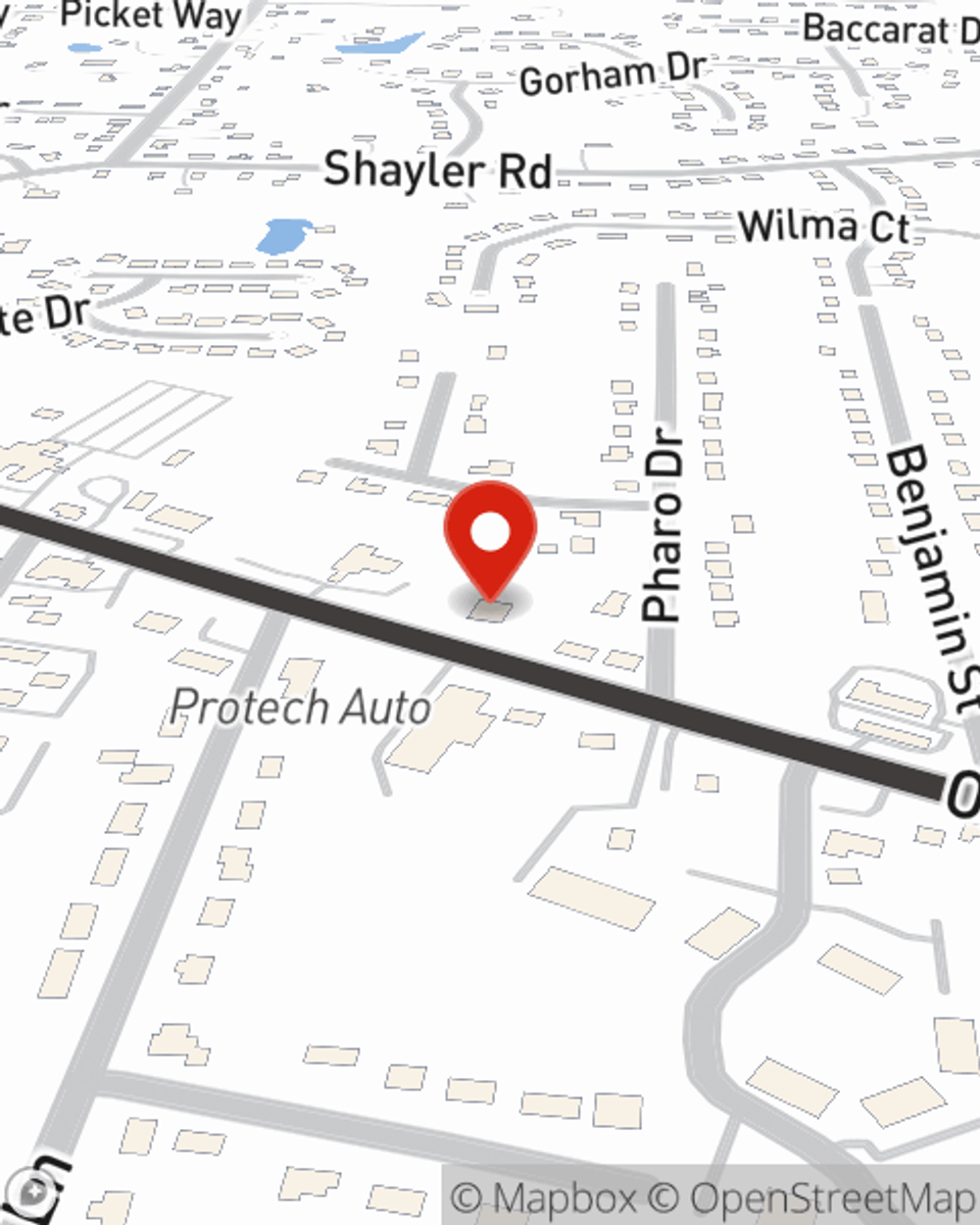

- Cincinnati

- Amelia

- Clermont County

- Bethel

- Hamilton County

- New Richmond

- Batavia

- Goshen

- Anderson Township

- Pierce Township

- Batavia Township

- Williamsburg

- Milford

- Felicity

- Mt. Orab

- Loveland

- Georgetown

- Owensville

- Norwood

- Warren County

- Maineville

- Symmes Township

- Mason

- Mariemont

Help Prepare Your Business For The Unexpected.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Letitia Fulkerson. Letitia Fulkerson gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of the top small business insurance companies in Cincinnati, and beyond.

No funny business here

Insurance Designed For Small Business

For your small business, whether it's a pet groomer, a bicycle shop, a bridal shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business liability, business property, and accounts receivable.

It's time to visit State Farm agent Letitia Fulkerson. You'll quickly observe why State Farm is the reliable name for small business insurance.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Letitia Fulkerson

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.